triple bottom stock screener

A triple bottom is generally seen as three roughly equal. 13 rows Triple Bottom is helpful to identify bearish stocks stock that have been trading.

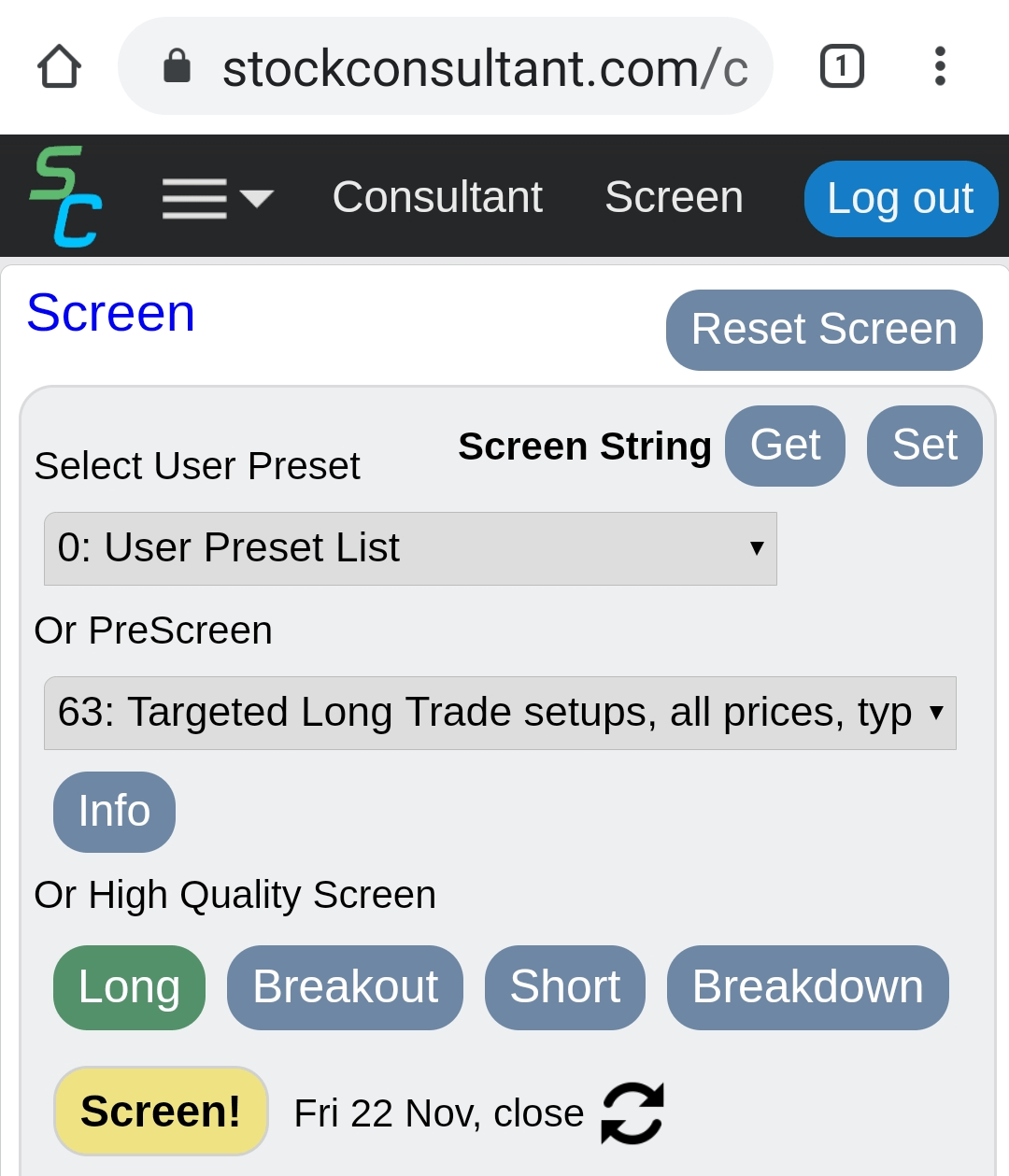

Chart Pattern Screener Double Top From 5 Mins To Monthly Ticks

Back to Traditional Patterns Stock Screener.

. Superior UI UX ie. Technical Fundamental stock screener scan stocks based on rsi pe macd breakouts divergence growth book vlaue market cap dividend yield etc. Features of using Chart Pattern Screener in MyTSR.

Features of using Chart Pattern Screener in MyTSR. The security tests the support level over time but eventually breaks. Single Page Application for faster download time Quick.

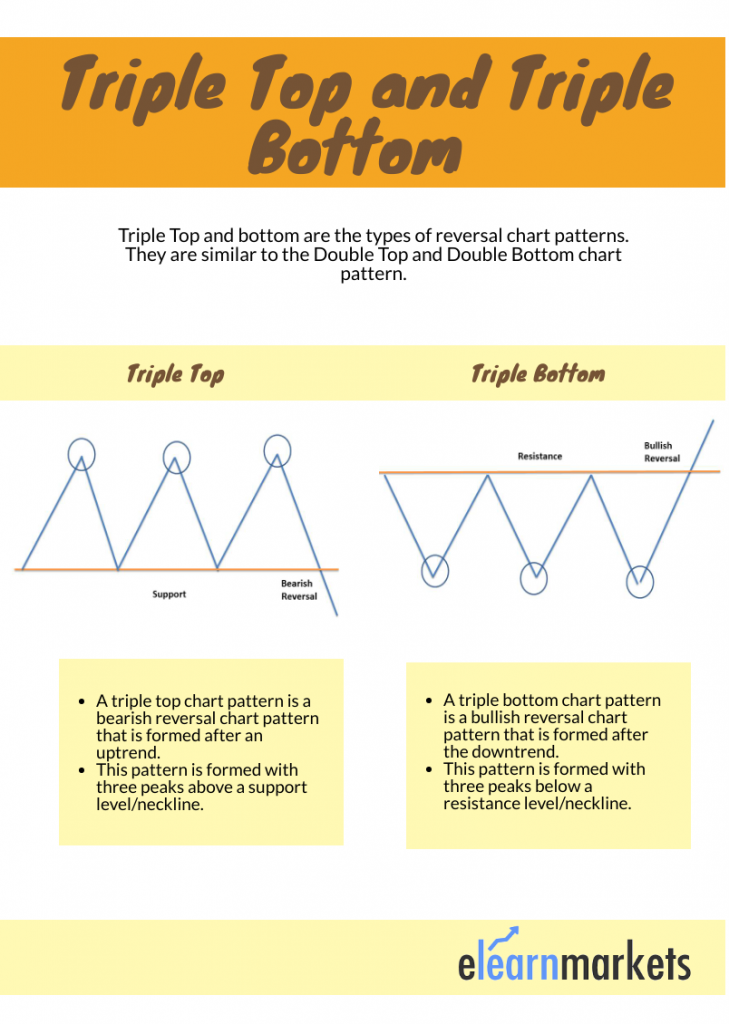

The Triple Bottom Pattern in stock trading is a chart pattern used in technical analysis thats identified by three equal lows followed by a breakout above the resistance level. Superior UI UX ie. This is a stock market Screener for NSE.

Single Page Application for faster download time Quick. These include Double Tops and Bottoms Bullish and Bearish. Features of using Chart Pattern Screener in MyTSR.

Triple BottomPattern Screener for Indian Stocks from 5 Mins to Monthly Ticks All Patterns Screener Learn Triple Bottom. This is similar to Kagi Renko and Three Line Break charts. Maverix stockholders may elect to receive either 392 in cash or 0360 of a Triple Flag share for each share held implying a premium of 10 to Maverix last close.

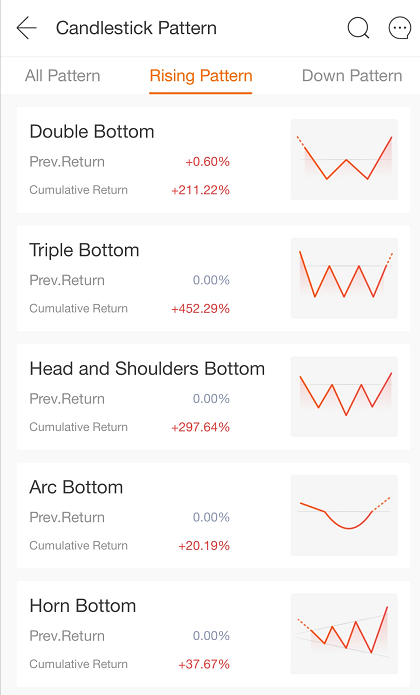

Triple Bottom Bullish Technical Fundamental stock screener scan stocks based on rsi pe macd breakouts divergence growth book vlaue market cap dividend yield etc. Technical Fundamental stock screener scan stocks based on rsi pe macd breakouts divergence growth book vlaue market cap dividend yield etc. Features of using Chart Pattern Screener in MyTSR.

Overview Charts Fundamental Technical Price Performance Financial Ratios Relative Strength Financial Strength Dividend. Features of using Chart Pattern Screener in MyTSR. Superior UI UX ie.

Triple bottom short most Technical Fundamental stock screener scan stocks based on rsi pe macd breakouts divergence growth book vlaue market cap dividend yield etc. Single Page Application for faster download time Quick. Superior UI UX ie.

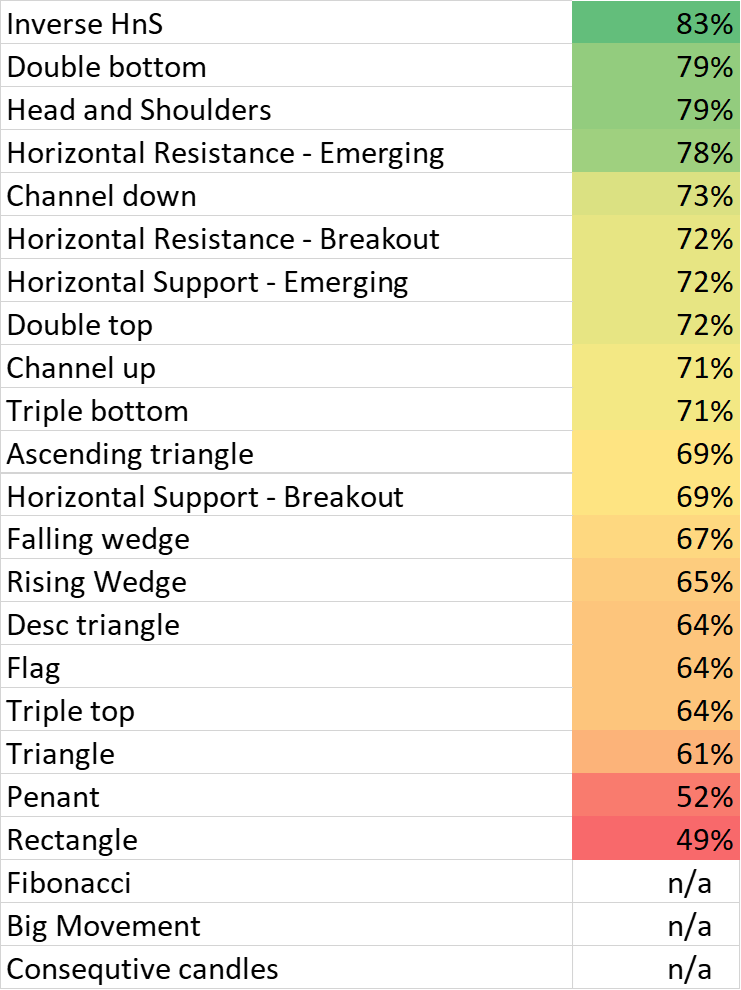

Superior UI UX ie. These include Double Tops and Bottoms Bullish and Bearish Signal formations Bullish and Bearish Symmetrical Triangles Triple Tops and Bottoms etc. Single Page Application for faster download time Quick.

A triple bottom is a visual pattern that shows the buyers bulls taking control of the price action from the sellers bears. Single Page Application for faster download time Quick. Superior UI UX ie.

Renko - Technical Analysis from. Single Page Application for faster download time Quick. Features of using Chart Pattern Screener in MyTSR.

NSE Daily chart Screener. The Triple Bottom pattern appears when there are three distinct low points 1 3 5 that represent a consistent support level. There are several chart patterns that regularly appear in PF charts.

The Ultimate Guide To Triple Top Triple Bottom Pattern Elm

Confirmed Double Top Stock Chart Pattern Stock Screener Stock Scanner

Stock Chart Patterns Today We Are Going To Teach You How To By Collabtrade Medium

Pattern Interpretation Futubull Help Center

Crypto Chart Patterns In Trading Altfins

How I Used The Ibd Screener To Identify 36 Launched Rocket Stocks Even So The Market Remains In Short Term Down Trend D 18 With A Red Gmi And A Daily Rwb Pattern Did

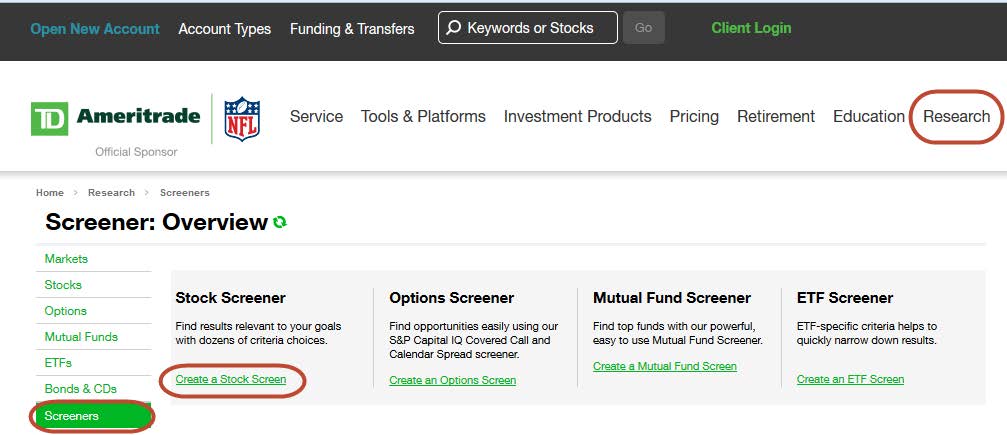

Move Like Jagger And Buy Like Buffett Stock Screener Ticker Tape

Help Technical Analysis Chart Patterns

Triple Bottom Reversal Chartschool

:max_bytes(150000):strip_icc()/dotdash_Final_Triple_Bottom_Definition_Jun_2020-01-38534512050d4a0a8e7cefc9ebb3509f.jpg)

What Is A Triple Bottom Chart In Technical Analysis

Triplebottom Tradingview India

Reverse Head And Shoulders Chart Pattern Stock Screener Stock Scanner

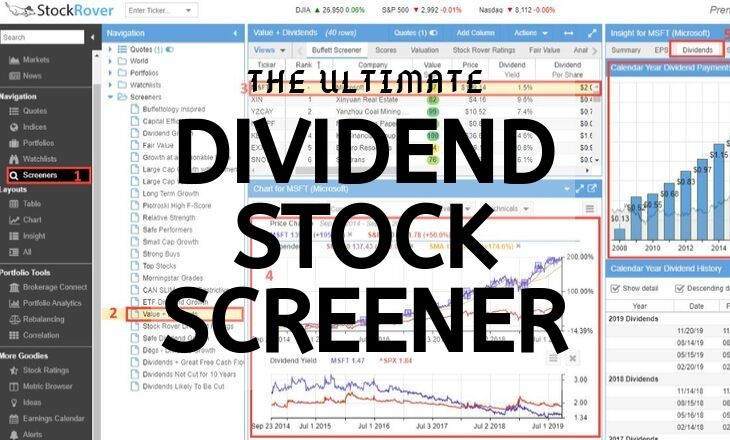

6 Steps To Build Your Dividend Stock Screener Strategy

Chart Pattern Scanner Chart Pattern Screener Price Action Screener